Sales

Sales - US

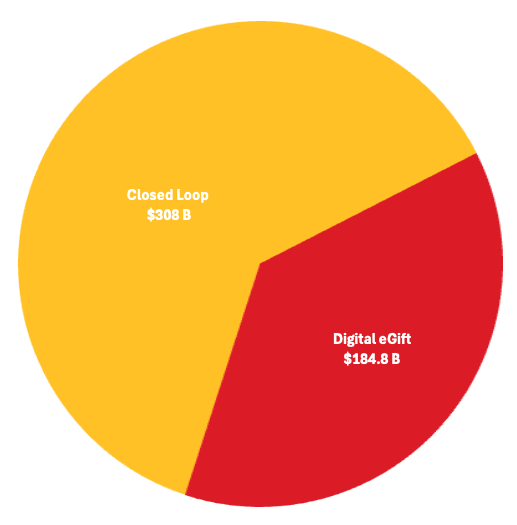

North America - Gift Card Growth - 2028

Digital Gift Cards are expected to grow to 60% of all Gift Card Spending.

Market Potential: The US digital gift card market is forecasted to grow at 17.1% annually.**

North America

Closed Loop = $308B

eGift = $184.8B

includes US, Canada, Caribbean, Mexico

United States

Closed Loop = $267.3B

eGift = $160.38B

Canada

Closed Loop = $26B

eGift = $15.6B

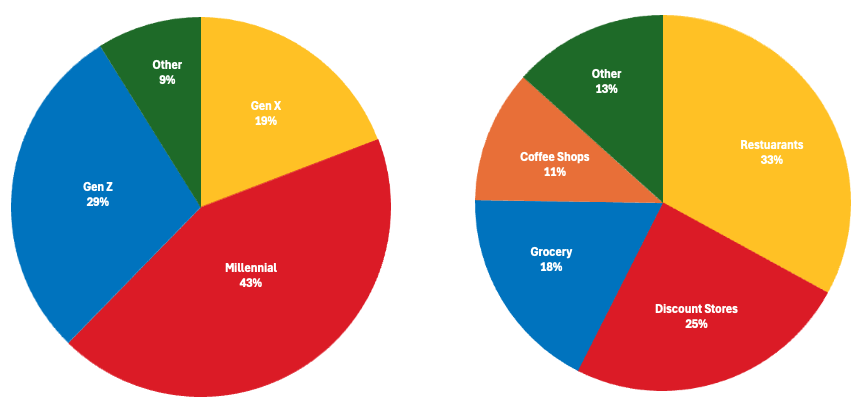

By Retail Segment

Purchasers by Generational Segment

Shell $240M

*Credence Research and Napco Research 2023

**The Entrepreneurship Reporter

Industry Standards (2025)

Emerging Digital Innovations

Fraud Mitigation and Rising Costs:

Direct Sales Alignment and Marketing

Promotional and Partner Collaboration

B2B Digital Initiatives

Shell US 2025 Sales Update

| FY24 Total |

FY25 Forecast |

FY25 YTD (Oct) |

FY24 YTD (Oct) |

Variance | |

|---|---|---|---|---|---|

| B2B Corporate | $27,700,174 | $31,906,332 | $16,600,029 | $23,613,671 | ($7,013,642 |

| B2B Reseller | $9,899,176 | $13,600,000 | $7,213,957 | $8,286,106 | ($1,072,149) |

| B2B Scrip | $8,886,257 | $10,965,158 | $4,667,910 | $7,055,668 | ($2,387,758) |

| B2B AAP | $84,431,914 | $94,128,560 | $57,417,274 | $72,542,244 | ($15,124,970) |

| B2B Total | $130,917,521 | $150,600,050 | $85,899,170 | $111,497,689 | ($25,598,519) |

| Consumer | $8,272,376 | $8,903,114 | $3,393,186 | $6,879,156 | ($3,485,970) |

| Dealer | $36,525,966 | $39,834,825 | $18,373,151 | $24,962,500 | ($6,589,349) |

| B2C Total | $44,798,342 | $48,737,939 | $21,766,337 | $31,841,656 | ($10,075,319) |

| Digital | $2,699,616 | $7,209,375 | $3,739,069 | $2,115,242 | $1,623,827 |

| Total Shell | $178,415,479 | $199,337,989 |

$111,404,576 | $145,454,587 | ($34,050,011) |

Overview

Growth Initiatives

Shell US 2026 Forecast

| Channel | Total | 2026 Forecast vs 2025 Actual Sales Total (LE) Variance $ |

|

|---|---|---|---|

| B2B Corporate | 2026 Forecast | $23,280,914 | $2,602,672 |

| 2025 Actual | $20,678,241 | ||

| 2024 Actual | $27,700,174 | ||

| B2B Reseller | 2026 Forecast | $9,334,460 | $507,433 |

| 2025 Actual | $8,827,027 | ||

| 2024 Actual | $9,899,176 | ||

| B2B Scrip | 2026 Forecast | $8,035,847 | $1,537,348 |

| 2025 Actual | $6,498,499 | ||

| 2024 Actual | $8,886,257 | ||

| B2B AAP | 2026 Forecast | $66,259,293 | ($3,047,651) |

| 2025 Actual | $69,306,944 | ||

| 2024 Actual | $84,431,914 | ||

| B2B Total | 2026 Forecast | $106,910,513 | $1,599,802 |

| 2025 Actual | $105,310,711 | ||

| 2024 Actual | $130,917,521 | ||

| Consumer | 2026 Forecast | $7,319,731 | $2,533,325 |

| 2025 Actual | $4,786,407 | ||

| 2024 Actual | $8,272,376 | ||

| Digital | 2026 Forecast | $4,349,147 | $25,704 |

| 2025 Actual | $4,323,444 | ||

| 2024 Actual | $2,699,616 | ||

| Dealer | 2026 Forecast | $31,123,670 | $1,187,053 |

| 2025 Actual | $29,936,617 | ||

| 2024 Actual | $36,525,966 | ||

| TOTAL | 2026 Forecast | $149,703,062 | $5,345,883 |

| 2025 Actual | $144,357,179 | ||

| 2024 Actual | $178,415,479 |

Sales - Canada

Shell Canada Processor/Production Transition

Targeted Industry Campaigns

Geographic Targeting

Direct Mail Campaigns

Resource Reallocation for Pipeline Growth

Enhanced Reseller and Promotional Activities

Shell Canada 2025 Sales Update

| FY24 Total |

FY25 Forecast |

FY25 YTD (Oct) |

FY24 YTD (Oct) |

Variance | |

|---|---|---|---|---|---|

| B2B Corporate | $3,497,071 | $10,032,804 | $3,772,526 | $2,893,211 | $879,315 |

| B2B Reseller | $310,500 | $384,175 | $199,750 | $229,250 | ($29,500) |

| B2B Scrip | $1,805,825 | $2,111,010 | $996,325 | $1,279,100 | ($282,775) |

| B2B AAP | $8,305,940 | $8,225,884 | $4,598,880 | $5,434,200 | ($835,320) |

| InComm (new) | - | $1,500,000 | - | - | - |

| B2B Total | $13,919,336 | $22,253,873 | $9,567,481 | $9.835,761 | ($268,280) |

| Consumer | $113,575 | $133,586 | $71,035 | $93,425 | ($22,390) |

| Dealer | $17,382,921 | $19,431,637 | $9,256,700 | $11,726,246 | ($2,469,546) |

| B2C Total | $17,496,496 | $19,565,223 | $9,327,735 | $11,819,671 | ($2,491,936) |

| Digital | - | $250,000 | - | - | - |

| Total Shell | $31,415,832 | $42,069,096 | $18,895,216 | $21,655,432 | ($2,760,216) |

Overview

Growth Initiatives

2026 Canada Forecast

| Channel | Total | 2026 Forecast vs 2025 Actual Sales Total (LE) Variance $ |

|

|---|---|---|---|

| B2B Corporate | 2026 Forecast | $5,187,635 | $715,109 |

| 2025 Actual | $4,472,526 | ||

| 2024 Actual | $3,497,071 | ||

| B2B Reseller | 2026 Forecast | $5,411,000 | $5,091,250 |

| 2025 Actual | $319,750 | ||

| 2024 Actual | $310,500 | ||

| B2B Scrip | 2026 Forecast | $1,775,000 | $78,675 |

| 2025 Actual | $1,696,325 | ||

| 2024 Actual | $1,805,825 | ||

| B2B AAP | 2026 Forecast | $8755,656 | $156,776 |

| 2025 Actual | $8,598,880 |

||

| 2024 Actual | $8,305,940 | ||

| B2B Total | 2026 Forecast | $21,129,291 | $6,041,810 |

| 2025 Actual | $15,087,481 | ||

| 2024 Actual | $13,919,336 | ||

| Consumer | 2026 Forecast | $115,485 | $19,450 |

| 2025 Actual | $96,035 | ||

| 2024 Actual | $113,575 | ||

| Dealer | 2026 Forecast | $16,224,083 | $467,383 |

| 2025 Actual | $15,756,700 | ||

| 2024 Actual | $17,382,921 | ||

| TOTAL | 2026 Forecast | $37,468,858 | $6,528,643 |

| 2025 Actual | $30,940,216 | ||

| 2024 Actual | $31,415,832 |

Trends | Market Research

US Regulatory Changes

Incentive Market Industry News & Trends

Digital eGift Cards

| Digital eGift Card | No Digital eGift Card |